Medigap Cost Comparison Chart Can Be Fun For Everyone

Wiki Article

The Apply For Medicare Diaries

Table of ContentsA Biased View of Medicare Select PlansTop Guidelines Of Medicare Select PlansThe Facts About Boomer Benefits Reviews UncoveredA Biased View of Medicare Select PlansThe Best Strategy To Use For Medicare Select Plans

Double Insurance coverage Dual insurance coverage QMBs are eligible for both QMB benefits and cash money and/or medical benefits. HFS pays the coinsurance quantity, if any kind of, while Medicare-covered SNF services are supplied. The revenue of QMB eligible persons is never ever used to Medicare-covered SNF services. Ms. R is a Medicare Component A recipient who remains in an assisted living facility (NH).

Considering that countable earnings is less than the one-person QMB income requirement, Ms. S is likewise eligible for QMB advantages. Number offered income to use to long-term treatment (see and also ). Enter the credit history amount in the MMIS LTC subsystem. (Go into the credit scores quantity in Section C of either Long-term Care Permission (Type 2299) or Long Term Treatment Permission Update (Type 2449), as proper.) Sends the facility a monthly prepayment kind based on the info in MMIS LTC system.

Does not accumulate the credit rating quantity revealed on the Form 2299 or Kind 2449 for these persons during a duration of Medicare-covered SNF services. Ms. D is a Medicare Component A recipient who is in an NH. She gets SSA of $670 regular monthly as well as Medicaid. Given that countable revenue is less than the someone QMB earnings standard, Ms.

Get in Ms. D's monthly offered revenue in the MMIS LTC subsystem. This amount if figured to be $640 ($670 - $30 = $640). Enter the effective day of 07/01 and also COS 65 in the MMIS LTC subsystem. (Enter revenue in Area C of Kind 2449; enter 07/01 effective day as well as COS 65 in Section D of Kind 2449.) When the coinsurance period starts, go into the reliable date of 07/21 as well as COS 72 in the MMIS LTC subsystem (medicare plan g coverage).

Apply sources that are extra than the resource restricts to the customer's month-to-month countable earnings when figuring the amount offered to apply to lengthy term care costs. Number the total up to apply to the August billing duration. Enter 08/01 in the MMIS LTC subsystem with the amount figured as a credit report.

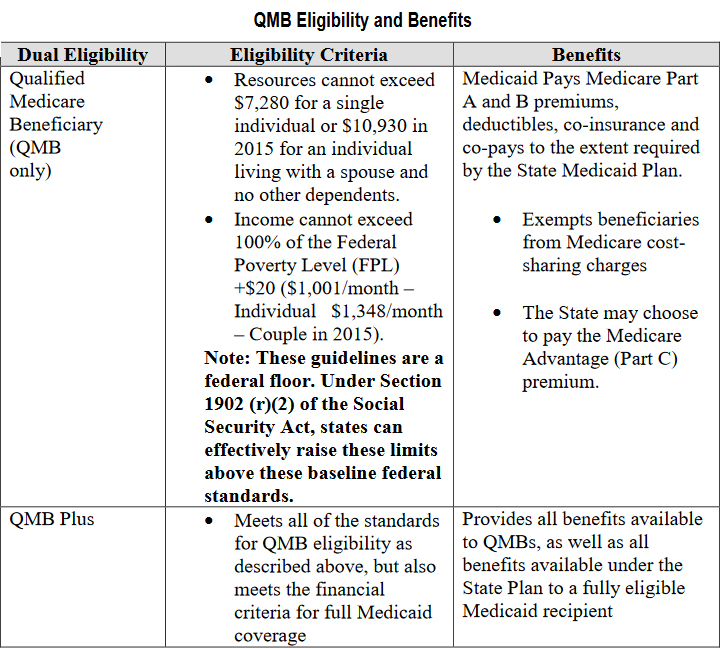

( Get in the 08/16 effective day and COS 70 in Area D of Form 2449.) QMB Only QMB just clients do not get Medicaid. HFS pays Medicare costs, deductibles, and also coinsurance just for Medicare-covered services. Do not apply the income of QMB just consumers to Medicare-covered SNF solutions. Mr. J is a Medicare Component A recipient living in an NH.

Mr. J has actually been found eligible for QMB advantages. HFS will certainly spend for just Medicare premiums, deductibles, and coinsurance fees for all Medicare-covered solutions. End Date Established Go into authorization in the MMIS LTC subsystem to begin a confess when: a QMB just client is receiving Medicare-covered SNF services; and also advantages go through coinsurance; and also completion day of the coinsurance is developed.

Medicare Supplement Plans Comparison Chart 2021 Pdf Things To Know Before You Buy

Go into the day the coinsurance period is efficient in the MMIS LTC subsystem. (: Enter in Areas A, C, as well as D of Form 2299.) Get in absolutely no in the MMIS LTC subsystem. (: Enter in Area C of Type 2299 under "Quantity".) Get in the day adhering to the day that the coinsurance period has been fulfilled in the MMIS LTC subsystem.

( Total Kind 2449 when Medicare-covered SNF solutions end.) Use Code D9, Discharge Location - Other, for this purchase. apply for medicare. No settlement is made for the discharge day for Code D9 discharges.

Boomer Benefits Reviews Fundamentals Explained

(Medicaid typically pays much less than Medicare does for the very same services.) When Medicare's repayment is greater than the Medicaid price for a solution, Medicaid might not pay anything for QMB cost sharing but QMB enrollees still can not be billed greater than a little co-pay (if one is allowed under Medicaid).This can develop a predicament for healthcare providers who aren't accustomed to dealing with dual eligibles as well as is a reason some enrollees choose not to share their status as a QMB with every medical provider - shingles shot cost. Medigap insurers can not purposefully offer a Medicare additional insurance plan to QMB enrollees (and this restriction also applies to those receiving complete Medicaid advantages) - boomer benefits reviews.

Example: Melba's earnings and assets are within QMB limitations. She does not want QMB to cover Medicare co-payments and deductibles.

Fascination About Medigap Cost Comparison Chart

He copes with his partner, Joan, and also their 4 children. Activity: Use a household dimension of six for QMB. For MA/CADI make use of a family size of one. Always make use of a home dimension of one to figure out QMB eligibility for an individual that is eligible for the Elderly Waiver (EW). Instance: Sue looks for EW and is qualified for Medicare.Report this wiki page